THUNDER GOLD INTERSECTS 941.0 g/t Au OVER 1.50 METRES WITH VISIBLE GOLD AT TOWER MOUNTAIN

Thunder Bay, Ontario March 20, 2023: Thunder Gold Corp. (formerly White Metal Resources Corp) (TSXV: TGOL) (FRA: Z25) (OTCMKTS: TNMLF) (“Thunder Gold” or the “Company”) is pleased to announce results from the first three holes of the 2023 phase one drill campaign currently underway at the Tower Mountain Gold Property, located 50-km west of Thunder Bay, ON, in the Shebandowan Greenstone Belt.

Highlights:

• TM23-137 intersected 941.0 g/t Au over 1.50 metres with multiple sites of visible gold observed at a depth of 126.7 metres downhole within a broader interval averaging 1.81 g/t (CAPPED at 30.0 g.t Au) over 41.0 metres;

• TM23-137 also intersected 0.77 g/t Au over 23.0 metres and 0.83 g/t Au over 58.0 metres;

• TM23-138 intersected 1.26 g/t Au over 17.5 metres and 0.71 g/t over 119.0 metres;

• TM23-136 intersected 0.68 g/t Au over 12.0 metres and 0.75 g/t Au over 11.7 metres;

• The three holes establish 200 metres of mineralized strike length along a previously untested N-S corridor;

• All three holes terminate in mineralization;

• This new zone, identified by geophysics, offers over 1000 metres of untested strike length and remains open in all directions.

Wes Hanson P.Geo., CEO of Thunder Gold notes: “Any time you come out of the gate with visible gold and the highest grade ever reported from a property with over 25,000 historical core samples, you’ve got to be excited. The rather impressive 941.0 g/t Au reports over a 1.5 metre interval and is driven by multiple sites of visible gold occurring within a centimetre scale quartz-carbonate-tourmaline vein intersected at a depth of 126.7 metres downhole. The vein occurs within a 41.0 metre interval averaging 1.81 g/t Au (interval capped at 30.0 g/t Au). The cap ONLY affects the 941.0 g/t interval containing the observed visible gold, all remaining assays within the 41.0 metre interval range from 0.09 to 5.80 g/t Au.

The results from the first three holes clearly demonstrate the validity of our exploration model and the validity of Induced Polarization (“IP”) as an efficient, accurate, exploration vector. All three holes intersected widespread, low-tenor (+0.10 g/t Au) gold mineralization from surface to the end of each hole as anticipated. Holes TM23-137 and 138 intersected elevated gold grades (+0.30 g/t) over intervals ranging from twelve (12) metres to one hundred and nineteen (119) metres, returning weight averaged grades ranging from 0.68 to 1.81 g/t Au. The frequency of intervals greater than 0.30 g/t Au is double that of the historical data population, as predicted.

In simple terms, these holes, targeting an untested IP anomaly along a 1000-metre strike length, are returning high gold grades, more frequently than the historical data set. It is important to note that the average reported grades are consistent with the average operating and reserve grades reported at all large-tonnage, low-grade open pit mines and development projects in Canada today.

The Company is also pleased to report that inversion of the recently completed IP survey is nearly complete. Preliminary analysis has identified new targets to the east and south of the Tower Mountain Intrusive Complex with a similar response to the known areas of mineralization. The preliminary interpretation has also isolated strong north-south lineaments, the longest and strongest of which is the focus of the phase one drill campaign currently 50% completed. This lineament extends for over 1000 metres of untested strike length. With only 20% of this untested area assayed, we are are already seeing strong evidence supporting our conceptual exploration model and we continue to demonstrate the validity of a cheap, cost-effective primary exploration vector. We are also beginning to piece together a working geological model which will guide future exploration. We see a unique opportunity at Tower Mountain: a path towards a large-tonnage, low-grade gold discovery located in a premium mining jurisdiction, fifty (50) kilometres from a major population centre, with year-round paved highway access, significant exploration upside, viable predictive tools and low exploration costs. Our goal is to rapidly demonstrate the potential for a large-tonnage, low-grade gold discovery.”

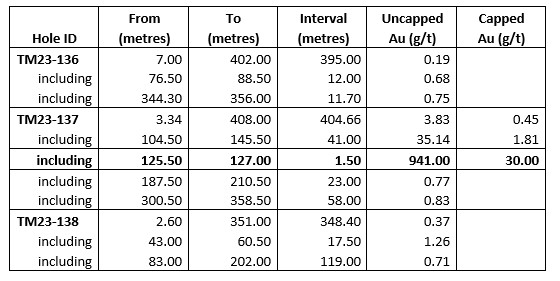

Table 1 – Summary of Significant Results

Interval length is reported down hole which is equivalent to true width.

A grade cap of 30.0 g/t was applied to estimate the capped average grades. This capping factor affect one sample in holeTM23-137 from 125.5 to 127.0 metres.

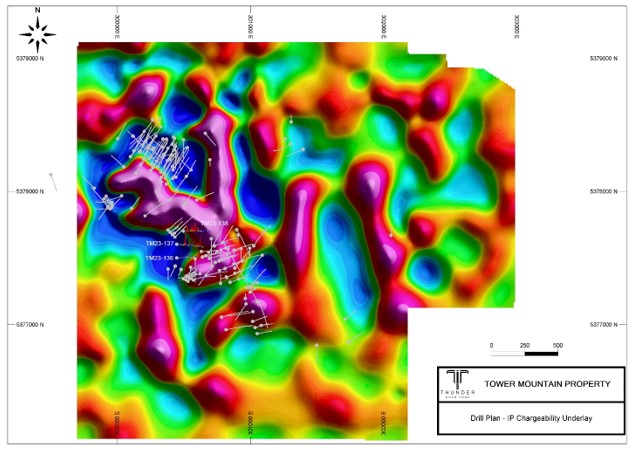

Figure 1.0 presents the current drill plan of the Tower Mountain Property. Holes TM23-136, 137 and 138 are highlighted for reference. The three holes define 200 metres of new mineralized strike length moving from south to north, from the Bench target.

The underlay is a filtered version of the current working IP chargeability inversion. This data is still being interpreted and is subject to change but all changes are anticipated to be minor. The strong, linear, north-south trending finger is the primary exploration target being evaluated in the phase one drill program. This chargeable response measures 1000 metres along strike and is more than 200 metres wide.

Gold mineralization continues to be agnostic relative to rock type with gold occurring in both the alkali intrusives as well as the host volcanics. Alkalic syenites and monzonites are more prevalent approaching the main Tower Mountain Intrusive Complex. These intrusives postdate the volcanics and appear to have generated extensive micro-fracturing of the host volcanic rocks that were later flooded with fine pyrite and possible gold. Late quartz-carbonate veins with coarse visible gold are interpreted to represent the final stage of mineralization.

FIGURE 1 – Diamond Drill Plan – March 2023 – Tower Mountain

Figure 2.0 is a photograph of the visible gold observed in TM23-137 at a downhole depth of 126.7 metres. A Canadian one-dollar coin (Loonie) is used as a size reference. A large piece of visible gold has been highlighted in the white circle – with arrows pointing to numerous other visible gold sections.

FIGURE 2 – TM23-137 – Visible Gold (941.0 g/t Au from 125.5 to 127.0 metres).

Quality Assurance and Quality Control

Diamond drilling utilizes NQ diameter tooling. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical and geological data and subjected to other physical tests including oriented core measurements and magnetic susceptibility analysis. Samples are identified, recorded, split by wet diamond saw or hydraulic splitter, and half the core is sent for assay with the remaining half stored on site. A standard sample length of 1.5 meters is employed, varying only at major lithological contacts. Certified standards and blanks are randomly inserted into the sample stream and constitute approximately 5-10% of the sample stream. Standard and blank performance is monitored with any failures evaluated and investigated to determine if said failure is a result of error during submission. Any unexplained failures are identified and the five samples preceding and following the failure are re-assayed. Standards and blanks are inserted into the re-assayed interval stream as well to monitor analytical performance. Samples are shipped to the Activation Laboratories Ltd. facility in Thunder Bay, ON where sample preparation and analyses are completed. All samples are analyzed for gold using a 30-gram lead collection fire assay fusion with an atomic adsorption finish. All results greater than 5.0 g/t Au are re-assayed using a gravimetric analysis. All samples are also analyzed for 35-element induced coupled plasma analysis.

About the Tower Mountain Gold Property

The Tower Mountain Gold Property is located 5-km off the Trans-Canada highway, 50-km west of Thunder Bay, Ontario. The property lies within the late Archean Shebandowan greenstone belt, an emerging gold district in northwestern Ontario. The property consists of unpatented and patented lands totalling 1,968 ha. Exploration to-date suggests the property offers a large gold endowment. Gold mineralization is widespread, and diamond drilling has identified low-grade gold mineralization extending outward for at least 500-meters from a central alkalic intrusion known as the Tower Mountain Intrusive Complex. Drilling has established persistent gold grades from 0.1 to 1.0 g/t along a 1,500-meter-long x 500-meter wide x 500-meter deep block of volcanic-volcanoclastic rocks immediately west and adjacent to the central alkalic intrusion. The remaining 6,000 meters of strike length surrounding the intrusion are untested. Tower Mountain shows many of the classic indicators of being an Intrusion Related Gold Deposit, which is a highly desirable exploration target.

About Thunder Gold Corp.

Thunder Gold Corporation, formerly White Metal Resources. is a junior exploration company focused on gold discovery in Canada. For more information about the Company please visit www.thundergoldcorp.com

On behalf of the Board of Directors,

Wes Hanson, President and CEO

For further information contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.