Thunder Bay, Ontario January 31, 2023: Thunder Gold Corp (formerly White Metal Resources Corp) (TSXV: TGOL) (FRA: Z25) (OTCMKTS: TNMLF) (“Thunder Gold” or the “Company”) is pleased to announce a 4,000-metre diamond drill program at the Tower Mountain Gold Property, located 50-km west of Thunder Bay, ON.

Recent highlights include:

• 4.0 km2 Induced Polarization (“IP”) survey completed, interpretation in progress with results expected mid-February, 2023;

• Preliminary inversions of the North and East survey blocks indicate chargeable anomalies similar to those observed to be coincident with the Bench, Ellen and A targets to the west;

• 4,000-metre drill contract awarded, estimate mid-February, 2023 start date. All in costs estimated at less than $250 / metre;

• Phase One drilling focused on the undrilled, core chargeable response that sits north of the Bench and west of the A and Ellen targets;

• Remainder of the planned Phase One program shall test prioritized geophysical targets to the North, East and South of the Tower Mountain Intrusion Complex (“TMIC”);

Abitibi Geophysics (Val d’Or, QC), have completed the previously announced 4.0 km2 Distributed Array (“DasVision”) Induced Polarization (“IP”) survey, expanding the IP footprint to the north, east and south of the TMIC, interpreted to be the potential source of gold mineralization at Tower Mountain.

The Company is pleased to announce that it plans to resume diamond drilling at Tower Mountain in February, 2023. A fully-funded, Phase One drill program totaling 4,000-metres is currently being finalized.

The Company’s main objectives for 2023 are:

1) extend the limits of known mineralization through step out drilling;

2) demonstrate potential for discovery of higher-grade gold mineralization and

3) demonstrate potential for additional mineralization elsewhere within the assembled claim package.

Wes Hanson P.Geo., CEO of Thunder Gold notes: “We believe Tower Mountain offers a unique opportunity to define a large tonnage-low grade gold resource adjacent to the Trans Canada highway less than 50 kilometres from the city of Thunder Bay, ON. and that is what we intend to demonstrate with our Phase One drill program.

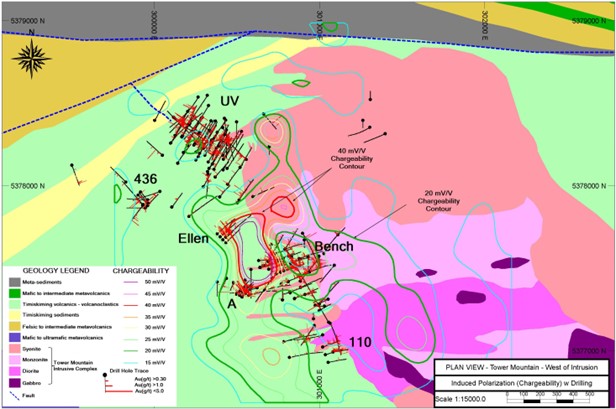

Our compilation work indicates gold mineralization is agnostic relative to alteration and rock type, occurring in both the intrusive suite as well as the host volcanics. No evidence of shearing, faulting or folding has been observed but significant evidence of brittle deformation is present, particularly in the host volcanics which appear micro-fractured in many locations based on ongoing petrographic work. Sulphide content remains the best indicator of gold mineralization, demonstrating a direct correlation. Our compilation work to date suggests excellent correlation between observed pyrite, IP chargeability and gold, particularly at the Bench, A, Ellen and 110 zones where 85 drill holes establish this relationship. These holes all lie within a broad, 20 mV/V chargeable response ( Ref. Figure 1.0 – green contour ) that in itself offers a compelling exploration target as the majority of this chargeable response is not adequately drill-tested.

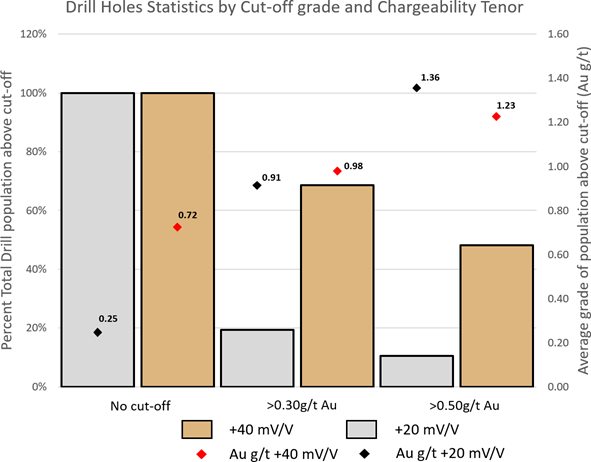

I am more anxious to test the higher chargeable response (+40 mV/V – red contour, Figure 1.0) as this response has been tested by a meager five (5) holes to date, all of which are localized in the southeast corner of the chargeable target. More than 95% of this chargeable response is undrilled. The five holes that have tested this chargeable response returned higher average grades (3x) (Ref. Table 1.0) and are (4x) more likely to contain intervals above the target 0.30 g/t cut-off grade (Ref. Figure 2.0).

Thw +40 mV/V response is elongated along a N-S axis, extending over 500 metres and measuring 200 metres in width. The DasVision IP suggests depth continuity of over 400 metres from surface. While the data set within the +40 mV/V chargeable response is small, it certainly suggests that it is a compelling exploration target, offering the potential to rapidly establish a maiden mineral resource with the added benefit of reduced exploration costs given the fact that existing trail and road access is already in place. Our 2023 Phase One program shall test this core response with a series of 100-metre spaced drill sections along the interpreted length of the chargeable response, moving from south to north. The target area falls within our existing approved exploration permits allowing access once the drilling contractor mobilizes to site. We estimate an all-in drilling cost of $250 per metre.”

Compilation Overview

Gold mineralization is confirmed to occur throughout the host volcanic-volcanoclastic sequence as well as within certain phases of the TMIC. Alteration is difficult to quantify visually and review of the geochemical data is ongoing. To date, the best correlation to gold grade is sulphide content which suggests a 1:1 relationship.

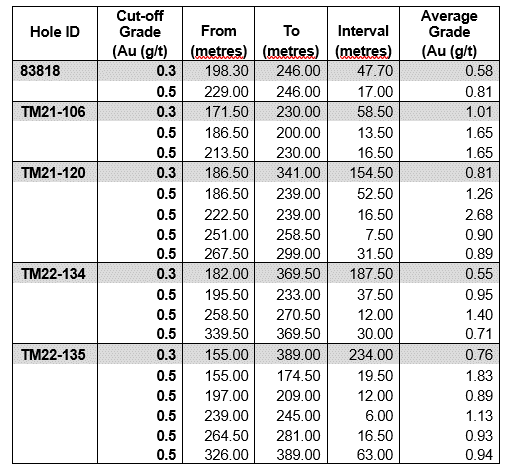

Two independent geophysical consultants have completed inversions of the 2021 IP dataset. The results are essentially identical with both interpretations highlighting a large, strong IP chargeable response located adjacent to the Bench target and extending in a northerly direction to the east of the UV deposit (Ref. Figure 1.0). The Company believes that the chargeable anomalies correlate to increased pyrite content which, in turn, correlates to elevated gold grade. This can be observed along the southwestern boundary of the TMIC where drilling has returned anomalous gold grades at the Bench, Ellen, A and 110 targets, all of which lie within a 20 mV/V chargeable response. Eighty-five (85) drill holes totalling 16,528 metres currently define the four targets. The Bench, Ellen and A targets all lie immediately adjacent to and just outside the 40 mV/V chargeable response. To date, only parts of five holes penetrate the 40 mV/V response, all of which are attributed as Bench drill holes, located in the southwestern corner of the chargeable feature. Table 1.0 summarizes the drilled intercepts for these five holes by cut-off grade. Figure 2.0 compares gold grades at various cut-off grades extracted from the 20 and 40 mV/V chargeable anomalies.

Table 1 – Summary Results of the Bench Drill Holes within 40 mV/V Chargeability Anomaly by Cut-off Grade

FIGURE 1 – Tower Mountain Regional Geology, 2021 Chargeability Contours w Drill Holes

FIGURE 2 – Tower Mountain Regional Geology, 2021 Chargeability Contours w Drill Holes

Corporate

The Company also announces that it has granted 4,600,000 options at a $0.05 strike price to Officers, Directors and Consultants effective January 30, 2023. The options have a 12-month term.

Quality Assurance and Quality Control

Diamond drilling utilizes NQ diameter tooling. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical and geological data and subjected to other physical tests including magnetic susceptibility analysis. Samples are identified, recorded, split by wet diamond saw, and half the core is sent for assay with the remaining half stored on site. A standard sample length of 1.5 meters is employed. Certified standards and blanks are randomly inserted into the sample stream and constitute

approximately 5-10% of the sample stream. Samples are shipped to the Activation Laboratories Ltd. facility in Thunder Bay, ON where sample preparation and analyses are completed. All samples are analyzed for gold using a 30-gram lead collection fire assay fusion with an atomic adsorption finish.

About the Tower Mountain Gold Property

The Tower Mountain Gold Property is located 5-km off the Trans-Canada highway, 50-km west of Thunder Bay, Ontario. The property lies within the late Archean Shebandowan greenstone belt, an emerging gold district in northwestern Ontario. The property consists of unpatented and patented lands totalling 1,968 ha. Exploration to date suggests the property offers a large gold endowment. Gold mineralization is widespread, and diamond drilling has identified low-grade gold mineralization extending outward for at least 500-meters from a central alkalic intrusion known as the Tower Mountain Intrusive Complex. Drilling has established persistent gold grades from 0.1 to 1.0 g/t along a 1,500-meter-long x 500-meter wide x 500-meter deep block of volcanic-volcanoclastic rocks immediately west and adjacent to the central alkalic intrusion. The remaining 6,000 meters of strike length surrounding the intrusion are untested. Tower Mountain shows many of the classic indicators of being an Intrusion Related Gold Deposit, which is a highly desirable exploration target.

About Thunder Gold Corp.

Thunder Gold Corporation, formerly White Metal Resources. is a junior exploration company focused on gold discovery in Canada. For more information about the Company please visit www.thundergoldcorp.com

On behalf of the Board of Directors, Wes Hanson, President and CEO

For further information contact:

Wes Hanson, CEO (647) 202-7686

whanson@thundergoldcorp.com

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and

exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.